TOPCU Rewards Checking

Why Bank with TOPCU?

For more than 86 years, people in Tucson have trusted TOPCU for banking services and the guidance to help them reach their goals. Whether you’re looking for rewards, interest bearing accounts or the latest mobile technology, our checking, savings and eServices have something for everyone.

Member Owned

One of Arizona’s oldest credit unions. Established by Tucson Firefighters, Police and City employees in 1935.

Checking and Savings

Be rewarded for the things you do every day with our Rewards Checking Account. Enjoy time-saving features along with the opportunity to earn an exceptional rate every month to help your money go further!

Fee Free ATMs

Enjoy fee-free withdrawals at over 55,000 Allpoint network ATMs. That’s over 3 times as many ATMs as those owned by Chase, Bank of America and Wells Fargo combined.

60,000+ fee-free ATMs nationwide

Access your money when you need it with fee-free ATMs1 at stores like Walgreens®, 7-Eleven®, Target®, Circle K, and CVS Pharmacy®.

Why open a Checking account with TOPCU?

A TOPCU Checking Account can help you make progress with your money.

| Financial Institution | Monthly maintenance fee | Monthly daily balance to waive monthly fee |

| TOPCU | $0 | $0 |

| Wells Fargo2 | $10 | $500 |

| Bank of America3 | $12 | $1,500 |

Find the right bank account for you.

Our checking and savings products come with no fees*—because why pay to bank? We offer a savings account that earns competitive rates. View our current Deposit Rates.

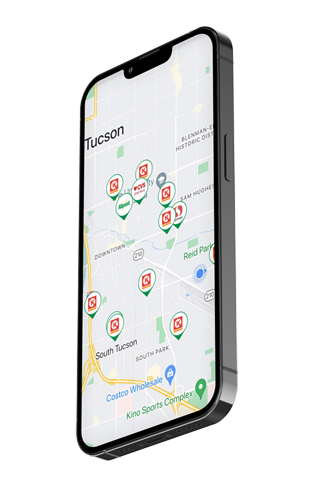

Manage your money on the go.

Bank almost anywhere, anytime with our top-rated mobile banking app and easy-to-use digital tools. It’s all right at your fingertips

A checking account for you.

Get all the checking features you need to bank where you are. Make deposits from work or from the couch using our top-rated mobile app, and get cash when you need it thanks to a network of more than 55,000 TOPCU and AllPoint® ATMs.

A checking account for your teen.

Get your teens on the path to financial freedom with a checking account that’s just for them. They’ll get their own debit card and the latest mobile banking tools, and you’ll get joint account access to keep an eye on things. Learn more

See what TOPCU Members are saying.

Have questions? Contact Us

Ready to make the SWITCH?

You’ll be glad you made the decision to switch to TOPCU! The process is as easy as visiting any of our branch locations. Our member services team will be happy to assist getting you signed up. You can also reach us by email at info@topcu.org or by phone at (520) 881-6262 ext. 702 or toll-free at (800) 440-8328.

Checking Account Types

| Type: |

Rewards Checking |

Classic Checking |

Mission Checking |

|---|---|---|---|

| Best For: | Members who use debit card frequently and carry low checking account balances | Members who carry higher balances and want to earn interest with full liquidity plus unlimited transactions | Members who want a fresh start with their finances |

| Opening Deposit Requirement | None | None | $20 |

| Monthly Fee | None | None | $20 |

| Interest-Earning | Earns interest on balances over $2,500 | Earns interest on balances over $2,500 | None |

| Online Banking | Free Online Banking and Bill Pay | Free Online Banking and Bill Pay | Free Online Banking and Bill Pay |

| ATM Transactions | Free at all in-network ATMs (Out-of-network fees apply) |

Free at all in-network ATMs (Out-of-network fees apply) |

Free at all in-network ATMs (Out-of-network fees apply) |

| Check Discounts | Free basic checks (first box ONLY) | Checks at cost | None |

| Debit Card | Free and earns $0.05 for each debit card transaction | Free | FREE – Direct deposit required for debit card |

| Direct Deposit | Not required | Not required | Not required |

| Monthly Statements | eStatement required | Choice of paper for $2.50 or FREE eStatements | Choice of paper for $2.50 or FREE eStatements |

*All members must open a basic savings account and maintain a $5 minimum balance.