✦ Trusted Since 1935

Debit & Checking Accounts

Why pay to manage your money? Say goodbye to monthly, minimum balance, and transfer fees

ATMS in Tucson

Downloads

No Monthly Fees

ATMs Across the US

Member Support

No-minimum checking accounts

Unlock the potential of Every Transaction with Rewards Checking

Maximize your earnings with our Rewards Checking account, where your daily spending turns into earnings

TOPCU's Rewards Checking Account

Every purchase earns money back: 10 cents per transaction for the first two months, then 5 cents ongoing. It’s your everyday spending, rewarding you.

Embrace Financial Freedom:

No monthly maintenance fees and no minimum balance requirement.

Convenient Access Across Tucson and Beyond:

Enjoy over 70 fee-free ATMs across Tucson, including popular locations like Walgreens®, 7-Eleven®, Target®, Circle K, and CVS Pharmacy®. Plus, gain access to an extensive network of 60,000+ fee-free ATMs nationwide, ensuring your money is always within reach. Locate ATMs

Ready to make the SWITCH?

You’ll be glad you made the decision to switch to TOPCU! The process is as easy as visiting any of our branch locations. Our member services team will be happy to assist getting you signed up. You can also reach us by email at info@topcu.org or by phone at (520) 881-6262 ext. 702 or toll-free at (800) 440-8328.

Checking Account Types

| Type: |

Rewards Checking |

Classic Checking |

Mission Checking |

|---|---|---|---|

| Best For: | Members who use debit card frequently and carry low checking account balances | Members who carry higher balances and want to earn interest with full liquidity plus unlimited transactions | Members who want a fresh start with their finances |

| Opening Deposit Requirement | None | None | $20 |

| Monthly Fee | None | None | $20 |

| Interest-Earning | Earns interest on balances over $2,500 | Earns interest on balances over $2,500 | None |

| Online Banking | Free Online Banking and Bill Pay | Free Online Banking and Bill Pay | Free Online Banking and Bill Pay |

| ATM Transactions | Free at all in-network ATMs (Out-of-network fees apply) |

Free at all in-network ATMs (Out-of-network fees apply) |

Free at all in-network ATMs (Out-of-network fees apply) |

| Check Discounts | Free basic checks (first box ONLY) | Checks at cost | None |

| Debit Card | Free and earns $0.05 for each debit card transaction | Free | FREE – Direct deposit required for debit card |

| Direct Deposit | Not required | Not required | Not required |

| Monthly Statements | eStatement required | Choice of paper for $2.50 or FREE eStatements | Choice of paper for $2.50 or FREE eStatements |

*All members must open a basic savings account and maintain a $5 minimum balance.

✦ All About Accessibility

Unlock the potential of Every Transaction with Rewards Checking

Direct deposits, loan payments, and fund transfers are at your fingertips. Plus, with our Rewards Checking account, every transaction you make earns you money. For the first two months, you get 10 cents back for every transaction. But the rewards don’t stop there. After the first two months, you continue to earn 5 cents back on every transaction.

FAQs

Activating Your Debit Card

Activate your card by dialing : 1-800-631-3197

1. Choose your language option

2. Follow the prompts to enter your card number

3. Follow the prompts to verify the cardholder

4. Once the process is complete, hang up

Changing Your PIN (Personal Identification Number)

Change your PIN by dialing 1-888-886-0083

1. Choose your language option

2. Follow the prompts to enter your card number

3. To change your PIN press 1

4. Follow the prompts to verify the cardholder

5. Follow the prompts to choose your PIN

6. Once the process is complete, hang up

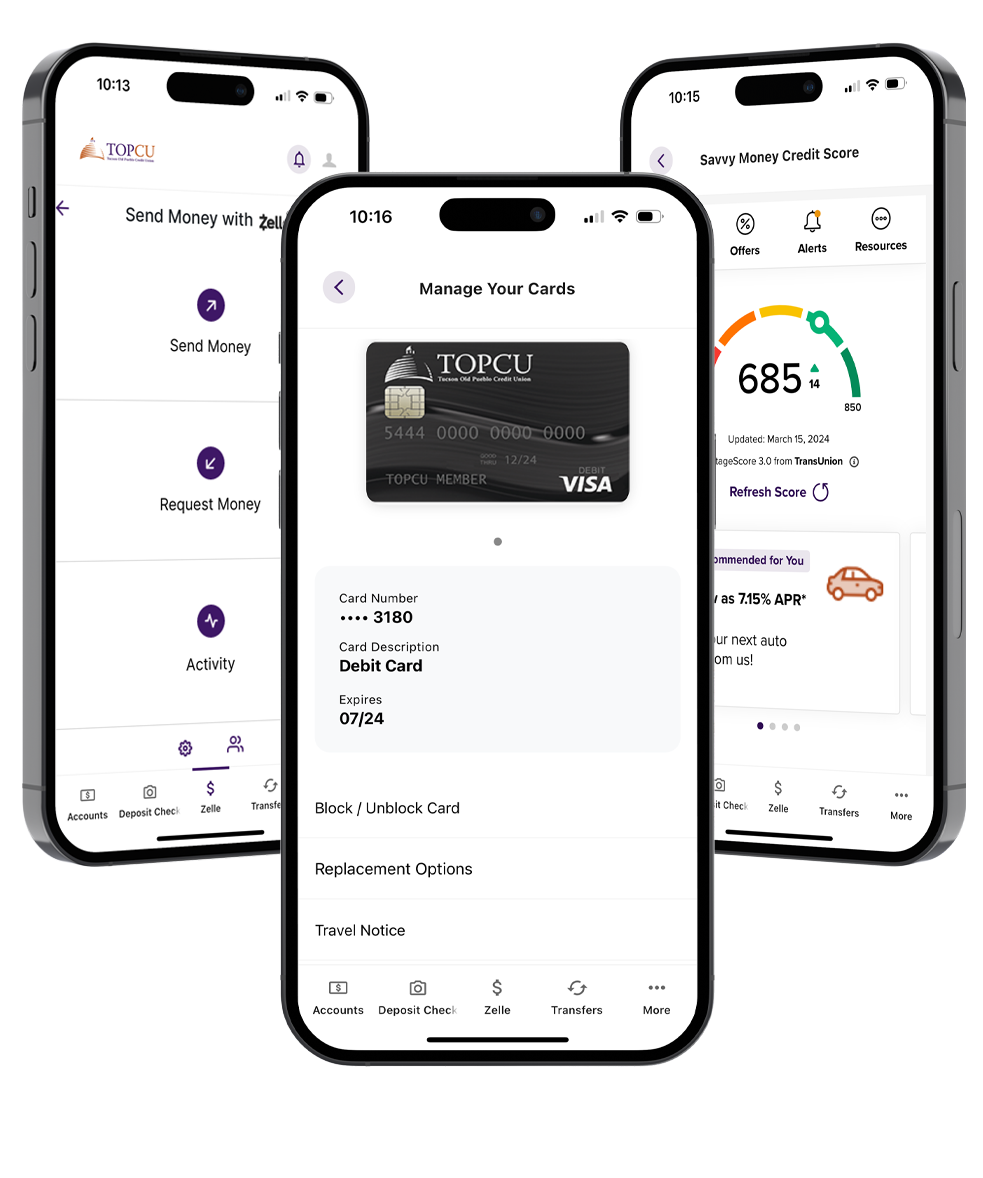

Blocking your Debit Card Online

1. Log on to online banking

a. Don’t have a user id? Click on “Not Enrolled, Enroll Now!”

2. Click on settings

3. Click settings

4. Click on ATM/Debit Card

5. Check the box next to Block

6. Click submit

File a Dispute

1. Complete the Online Debit Card Dispute form

TOPCU Lost/Stolen Debit Cards

During Business Hours:

1. Call (520) 881-6262, option 1.

2. If you are calling long distance, dial 1-800-440-8328.

You may also call outside of TOPCU’s regular business hours:

1. In the US or toll free the number is 866-553-2941

2. For calls outside the US or collect the number is 727-299-2449

At TOPCU, we are working hard to protect you from identity theft. Identity theft can take the form of acquiring the information from your debit card and using it for fraudulent transactions. The information is often sold to various organized crime groups around the world, and transactions are processed outside of the United States.

To protect you from this type of activity, we have identified several countries where these transactions are occurring. We have blocked all debit card activity from these countries, which means that you will not be able to access your account with your debit card when you are travelling to a blocked country. But more importantly, criminals who attempt to access your account fraudulently will not be able to do so either due to our blocks.

Our current list of blocked countries includes Japan, Malaysia, Iran, Iraq, Libya, Syria, Pakistan, Afghanistan, Saudi Arabia, Nigeria, Sudan, Somalia, Sierra Leone, and the countries that were part of the former Soviet Union. Because this is an evolving problem, we may update our list from time to time as we identify areas of high fraudulent activity.

Setting up Visa Purchase Alerts

With TOPCU account alerts powered by Visa, you can receive near real-time updates on your Visa® credit or debit card activity. So you can act quickly to help reduce fraud and monitor your account, wherever you are. After your Visa card has been used, you’ll receive an alert through text message or email. If there is fraudulent activity, you can find out within minutes and act quickly to resolve the situation.

How you use the service is up to you. You can choose to receive alerts when your Visa card is used for purchases over a specified amount, online transactions, purchases outside the United States, and more. You can even customize the purchase amount threshold—for example, setting it to only receive alerts for purchases above $50.

Select the delivery options that best meet your needs, with text messages, emails, or both for extra security and convenience. Each alert contains important information, including the purchase amount, merchant name and location (if available), and the last [four] digits of the Visa card used to keep you best informed.

All this for free for TOPCU Visa cardholders. Click here to sign up for Visa Purchase Alerts today.

Disclosure: Actual time to receive Alerts powered by Visa dependent on wireless service and coverage within area. Alerts service may not be available in all areas. Gasoline alerts may not include purchase amount. Account activity qualifying for Alert service may vary by issuer. Additional restrictions apply.