✦ Trusted Since 1935

Tucson Old Pueblo Rates

Browse our current rates below for TOPCU Savings products.

All Deposit Rates

All Deposit Rates

Certificates (CDs)

Certificates (CDs)

Money Market

Money Market

Savings Accounts

Savings Accounts

Loans

Loans

Auto Loans

Auto Loans

Rise High Savings Account

Rise High savings accounts give you a dedicated account to separate your savings into to save for short or long term goals.

- Open multiple Regular Share Savings to achieve different goals.

- Online savings accounts offer easy transfers using Online Banking and our Mobile app.

- Make unlimited deposits

- Access your funds immediately.

| Tier | APY* |

|---|---|

| $0.01+ | 3.55% |

*APY = Annual Percentage Yield. No minimum balance required. Rise High Yield Savings account annual percentage yield (APY) Rates are subject to change after account opening. Rates are current as of April 15th, 2025. and subject to change.

Money Market Savings

Reach new heights with a Money Market Account. As your savings grows, your interest rate increases too!

- Open multiple Regular Share Savings to achieve different goals.

- Online savings accounts offer easy transfers using Online Banking and our Mobile app.

- Access your funds immediately.

| Tier | APY* |

|---|---|

| $0 – $2,499.99 | 0.00% |

| $2,500 – $9,999.99 | 0.40% |

| $10,000 – $24,999.99 | 0.40% |

| $25,000 – $49,999.99 | 0.60% |

| $50,000 – $74,999.99 | 0.75% |

| $75,000 – $99,999.99 | 0.75% |

| $100,000 – 149,999.99 | 1.20% |

| $150,000 – $174,999.99 | 1.50% |

| $175,000 – $249,999.99 | 1.75% |

| $250,000 and above | 2.00% |

*APY=Annual Percentage Yield. The rate may change any time after the account is opened. Rates are subject to change without notice. Account fees could reduce the earnings on the account. Rates are current as of April 15th, 2025.

Share Certificate (CD)

A Certificate of Deposit offers a reliable and safe method to grow your savings. Our attractive CD rates get you even closer to your goals!

- Open multiple Regular Share Savings to achieve different goals.

- Online savings accounts offer easy transfers using Online Banking and our Mobile app.

- Access your funds immediately.

| Term | APY* |

|---|---|

| 6 month | 4.30% |

| 1 Year | 4.35% |

| 2 Year | 3.85% |

| 5 Year | 3.65% |

*APY=Annual Percentage Yield. Rates are subject to change without notice. Dividends are paid and compounded Monthly from date of deposit and are available for withdrawal. Penalty for early withdrawal will apply. Fees could reduce the earnings on this account.

IRA Savings

Whether you’re transferring a 401K or embarking on retirement planning, an Individual Retirement Account (IRA) provides an excellent starting point. It’s a smart way to accumulate savings for your golden years and can also reduce your tax burden.

| Tier | APY* |

|---|---|

| $0 – $2,499.99 | 0.00% |

| $2,500 – $9,999.99 | 0.40% |

| $10,000 – $24,999.99 | 0.40% |

| $25,000 – $49,999.99 | 0.60% |

| $50,000 – $74,999.99 | 0.75% |

| $75,000 – $99,999.99 | 0.75% |

| $100,000 – 149,999.99 | 1.20% |

| $150,000 – $174,999.99 | 1.50% |

| $175,000 – $249,999.99 | 1.75% |

| $250,000 and above | 2.00% |

*APY=Annual Percentage Yield. The rate may change any time after the account is opened. Rates are subject to change without notice. Account fees could reduce the earnings on the account. Rates are current as of April 15th, 2025.

IRA Certificate Rates

Whether you’re transferring a 401K or embarking on retirement planning, an Individual Retirement Account (IRA) provides an excellent starting point. It’s a smart way to accumulate savings for your golden years and can also reduce your tax burden.

| Term | APY* |

|---|---|

| 6 month | 4.30% |

| 1 Year | 4.35% |

| 2 Year | 3.85% |

| 5 Year | 3.65% |

*APY=Annual Percentage Yield. Dividends are paid and compounded monthly from date of deposit. Rates are subject to change without notice. Penalty for early withdrawal will apply. Account fees could reduce the earnings on the account. Rates are current as of April 15th, 2025.

Regular Share Savings

Become a member and part-owner of the credit union with this simple savings account designed to kickstart your financial future. Deposit $5 in your TOPCU Share Savings Account and gain access to all our products, services, and member benefits.

- Open multiple Regular Share Savings to achieve different goals.

- Online savings accounts offer easy transfers using Online Banking and our Mobile app.

- Access your funds immediately.

| Type | APY* |

|---|---|

| Savings | 0.15% |

| Rewards Checking | 0.01% |

| Classic Checking | 0.20% |

*APY=Annual Percentage Yield. The rate may change at any time after the account is opened. Rates are subject to change without notice. Account fees could reduce the earnings on the account. Rates are current as of April 15th, 2025.

✦ All About Accessibility

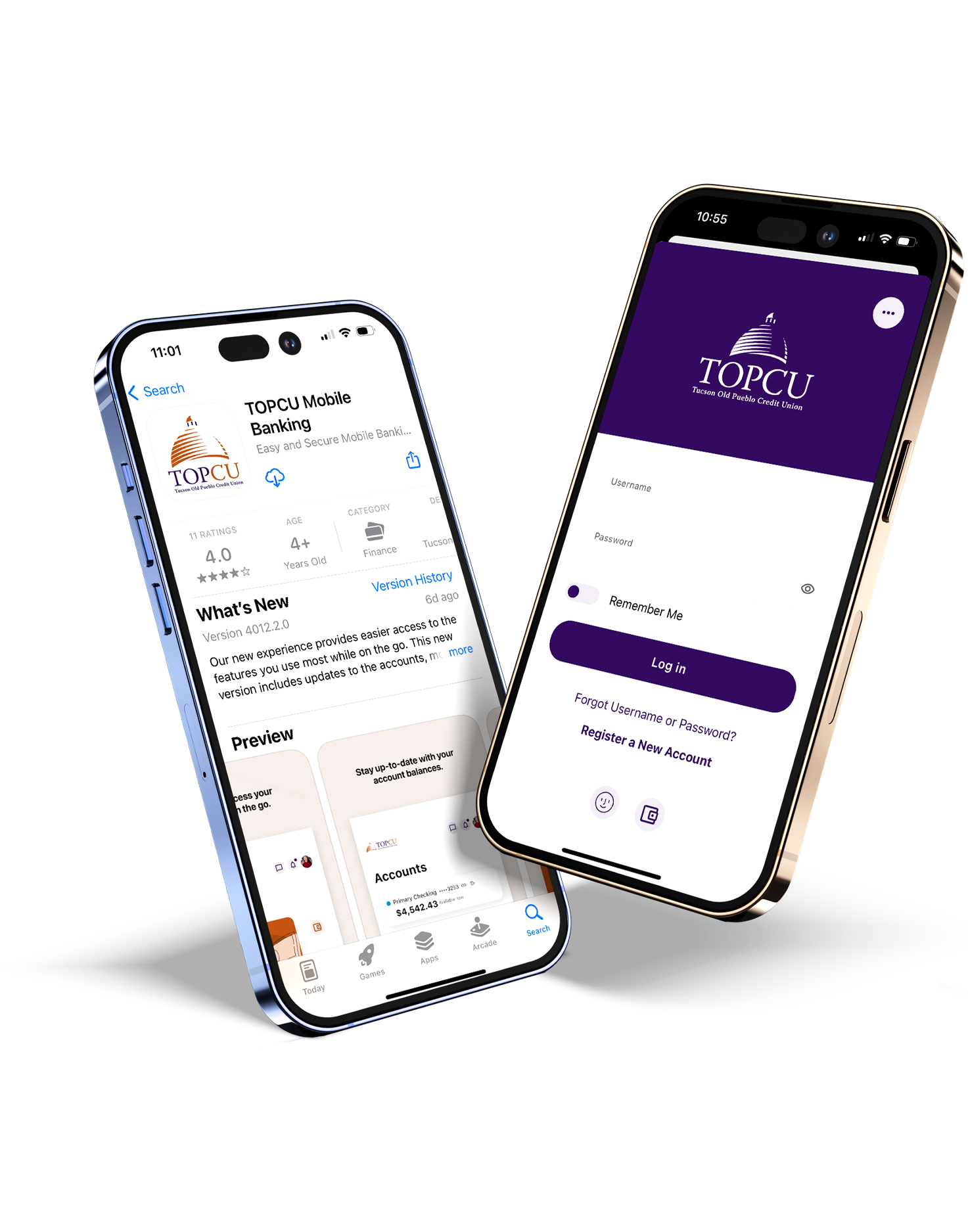

Revolutionize Your Banking with The TOPCU App

Check deposits, loan payments, and fund transfers are at your fingertips. Plus, get insights into your spending, access your credit score, and link all your external accounts for a full financial picture.

Join The Growing Community of Individuals & Businesses Across Tucson

Tucson Old Pueblo Credit Union opened its doors in 1935. Through the years, TOPCU has expanded services and our field of membership to serve the greater Tucson community.

Is TOPCU a Bank?

TOPCU is a not-for-profit organization that exist to serve Tucson members. Like banks, we offer direct deposit, debit cards , checking accounts, credit cards, loans, and provide a wide array of other financial service

What is a credit union?

1. Credit union resources are returned to you the member in the form of lower fees.

2. Credit unions are a more personalized way of handling personal finance; you will have a better chance at securing personal and small business loans at your local credit union.

3. Credit unions’ interest rates are lower compared to big bank rates. And, free checking is alive and well. Deposits are insured by the National Credit Union Share Insurance Fund.

4. Through CO-OP Network, members have the nation’s largest network of credit union ATMs – 28,000 surcharge-free locations (9,000 of which accept deposits)! And credit union service centers provide 4,000 nationwide shared branch locations for consumers.

Can I make Payments Online?

1. Log-in to Online Banking.

or

2. Set up new electronic transfers from another financial institution by providing the following:

TOPCU’s Routing Number:

13-digit number comprised of your account code, loan ID, and member number formatted as follows:

First Digit Account Code: 2 (for loans)

Next 2 digits: Loan ID

Last 10 digits: Membership number preceded by zeros (For example, for the solar loan of member# 0000123456 with loan ID #70, you would enter 2700000123456)

or

3. Mail your payment to: Tucson Old Pueblo Credit Union – 2500 E 22nd Street, Tucson, AZ 85713

4. Visit any of our branches or visit one of our shared branching locations.

Do you offer Skip a Pay?

Yes on all eligible loans .

Home Banking App Who’s Ready for Better?

With TOPCU’s home banking app, better is not just a promise—it’s a reality. Experience a suite of features designed to make your financial life easier and more secure.